4 Best Practices to Measure Your Payment Processing Security

With the growth of various financial services and e-commerce platforms, establishing an online business has never been easier. The tedious tasks that traditional businesses face are now streamlined through services and software.

However, with the good comes the bad. As we move towards an increasingly digital world, we open up our business to additional security vulnerabilities from bad actors.

And if we narrow our focus on e-commerce businesses, they lose billions of dollars annually because of fraudulent transactions. The same situation happens in other industries as well.

Even if you fully trust your payment processor, it’s highly advisable to do your due diligence and ensure maximum security. Whatever the potential weakness of your system might be, these three practices should help you find and fix them before you find yourself stuck between a rock and a hard place.

Importance of payment processing security

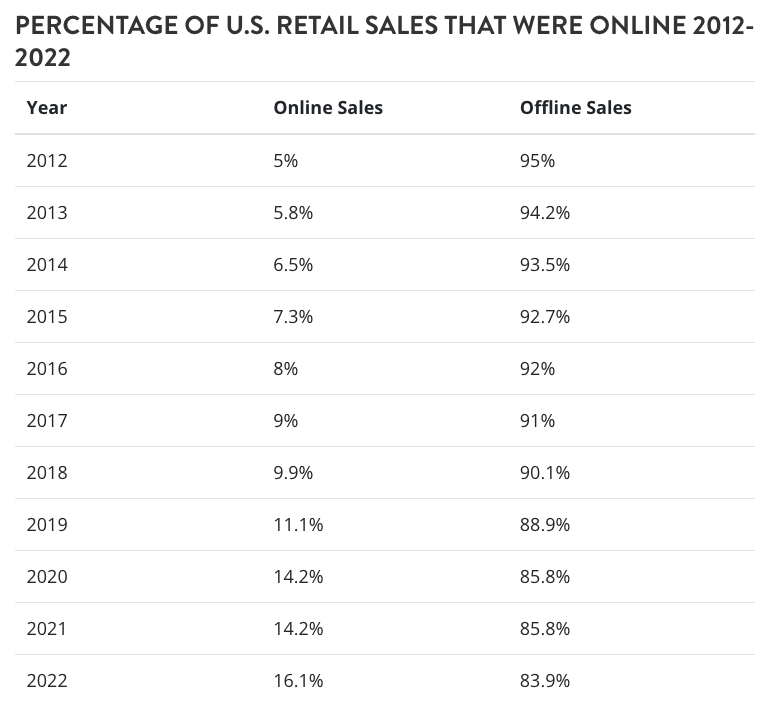

In the last decade, we’ve seen an increase in the amount of online transactions. This signifies that online shopping has become more popular among consumers, and it’s an upward trend, signifying that we can expect more online purchases in the future.

Retail shopping isn’t the only place where people spend money. Many businesses sell online in the form of services, plugins, and software, and they draw attention from both individuals and enterprises.

Once someone makes an online payment, they transmit sensitive information such as credit card numbers, bank account details, payment QR codes and personal or professional data. Both individuals and companies have the right to safe and secure transactions.

Online transactions can be intercepted or accessed by malicious individuals, and your job as a business owner or a security expert working for one is to minimize the chances of potential threats that can cause significant financial losses.

To further emphasize the importance of secure transactions, let’s discuss the potential problems malicious attacks can cause. A lawsuit is one of the most significant damages once a situation unfolds.

Regulatory bodies can fine you for causing financial harm to an individual or a company. However, the financial aspect of a security breach is only half of the problem. Your company’s reputation, and even your own, can be seriously damaged – a nightmare scenario that reputation management reseller knows all too well.

Cybersecurity breaches also disrupt other business operations. Imagine a marketer trying to attract a new audience for a company with a troublesome history of data breaches and security vulnerabilities.

Furthermore, hiring top talents in the industry will become much harder, as many reputable employees will avoid associating with such companies.

4 Best practices for measuring payment processing security

One part of improving your business is understanding the importance of payment processing security. The next step should be understanding the best practices to protect and satisfy your customers and clients.

Some methods require investing in additional software and employees, yet their cost is nowhere near the amount of money you’d have to pay to settle a lawsuit or recover financial losses from a breach.

1. Check your current security standard

In the context of observing and measuring your overall security, it’s important to understand which standards and security protocols you’re currently using.

We’ll cover multiple types of standards (likely you’re already using one by default). However, your current option might not ensure maximum security.

Depending on your business type, you’ll likely have registered customers. For example, most SaaS companies require you to create an account before you make your purchase.

On the flip side, e-commerce stores often allow quick transactions through a guest checkout option.

However, studies show that recurring customers spend more money on products than first-time customers. That’s why we’ll focus on security standards used in the sign-up process to help protect your most valuable customers.

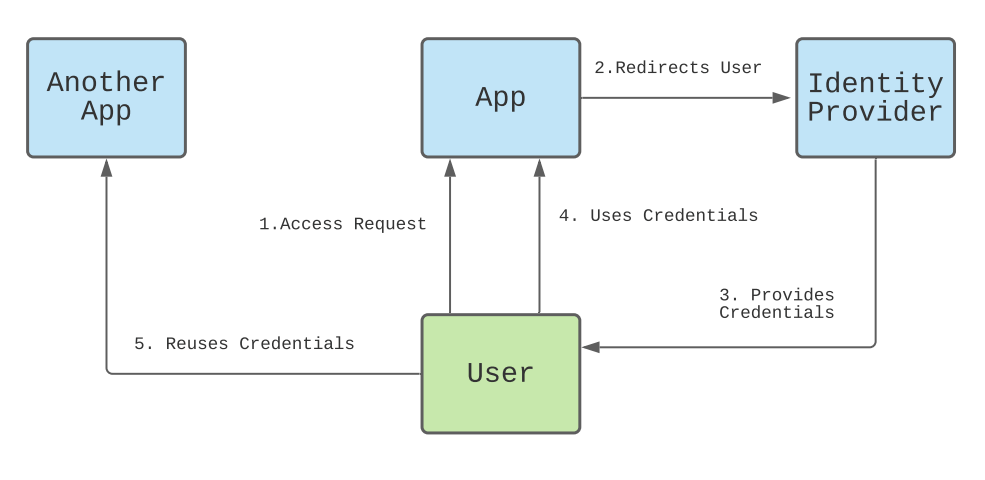

The clash here is often between SAML vs OAuth standards. While each has plenty of use cases, they have different workflows and are applied in distinct situations.

A quick breakdown of these two standards shows that SAML is great for large organizations, while OAuth offers better accessibility and ease of use.

Both of these standards could prove useful depending on your situation and whether you have a choice. However, OAuth has an advantage as it’s more modern and regularly updated.

2. Invest in the proper tools for a proactive approach

If you’ve spent even an hour on the internet in the past year, you’ve likely encountered discussions about artificial intelligence. Some people still deny its usefulness, while gurus try to oversell their ChatGPT and other generative AI courses to you.

Like always, the truth is somewhere in the middle. While it’s not a silver bullet, artificial intelligence can improve your daily processes and improve online payment security.

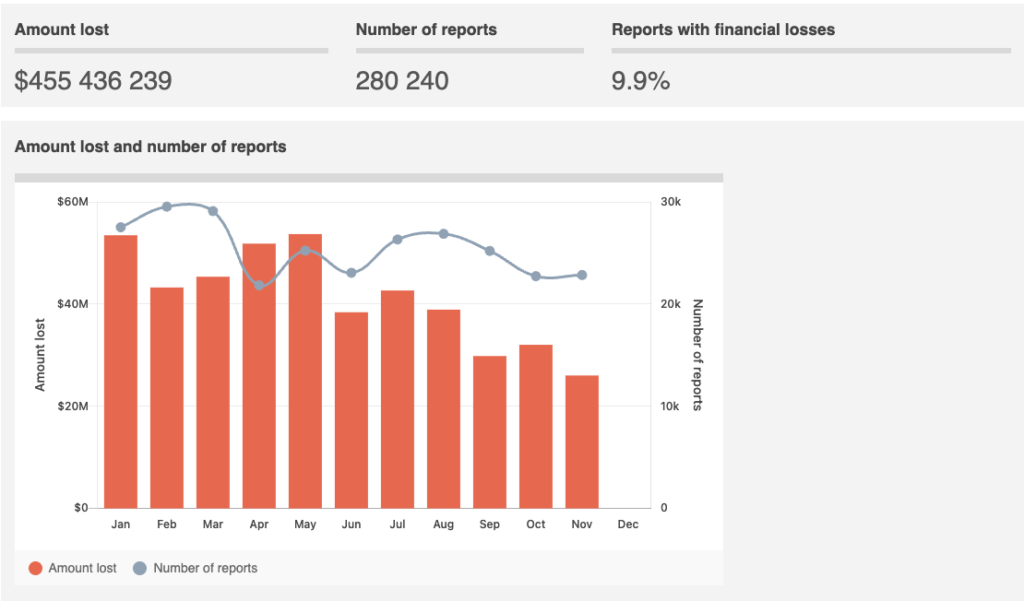

For example, advanced data analytics tools can help businesses analyze vast amounts of transaction data to catch any red flags that might turn into fraudulent activity. Keeping up with the latest technology trends in financial services is essential for enhancing security measures and offering superior customer experiences.

Instead of wasting time and resources on this tedious task (which is usually error-prone), business owners and decision-makers unlock a new perspective on their security through data visualization features.

These tools give insight into information such as transaction volumes, chargebacks, and customer reviews. Once you have this information laid out for you, it helps you make better decisions related to the security of your business and prevent problems before they occur.

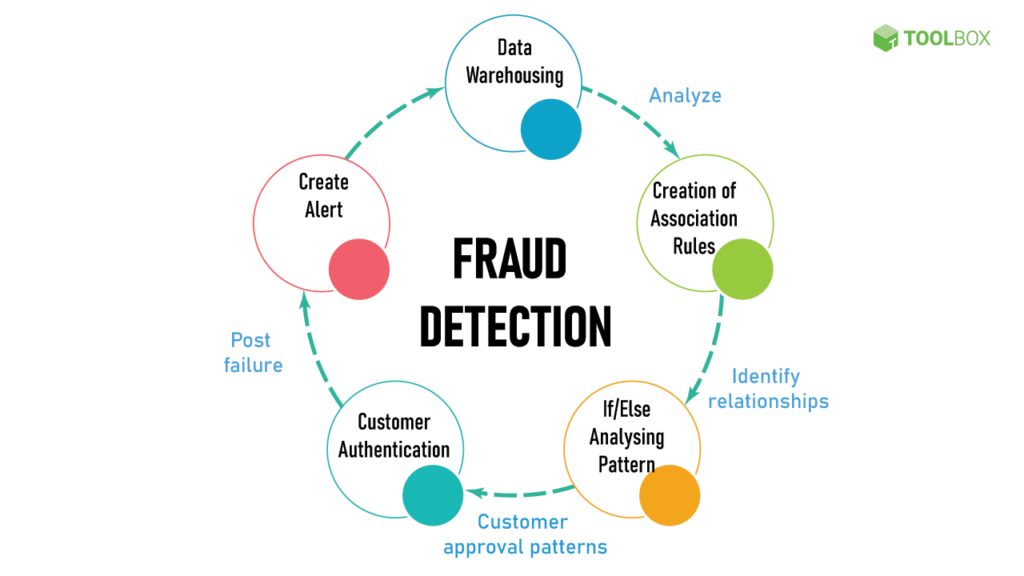

In other words, with the help of artificial intelligence, you can create an automatic fraud detection system to alert you when suspicious activity occurs. And if it does, a proactive approach can help prevent it from spreading like wildfire.

3. Ensuring compliance

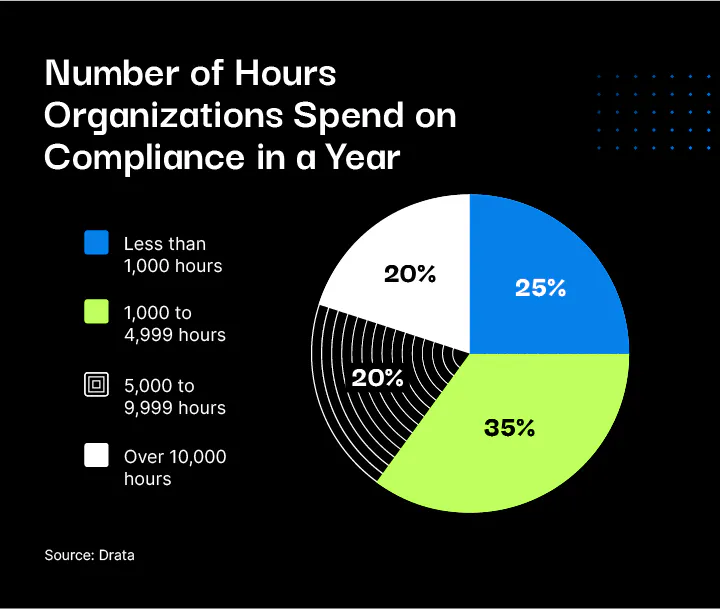

Besides the technical aspects, an important part of secure payment processing is staying compliant with current laws and regulations. Although monitoring compliance is nearly a full-time responsibility, following these regulations can serve as a roadmap for security.

Guaranteeing your customers’ safety from scams and fraud should always be a priority. Your business needs to be transparent and accountable, which is exactly what these regulations enforce.

Some of the most important regulations that you must follow include:

- Payment Card Industry Data Security Standard (PCI DSS),

- Second Payment Services Directive (PSD2)

- General Data Protection Regulation (GDPR.

In terms of measuring payment processing security, this section will help you understand just how important various laws and regulations are. They should serve as a benchmark for your business and whether you meet all the requirements.

PCI DSS

The world of finance has been around much longer than the internet. Credit card manufacturers have an important role in setting and improving security standards.

Key players involved in developing PCI DSS were Visa, Mastercard, American Express, and others. PCI DSS is an important standard that defines how credit card details are handled.

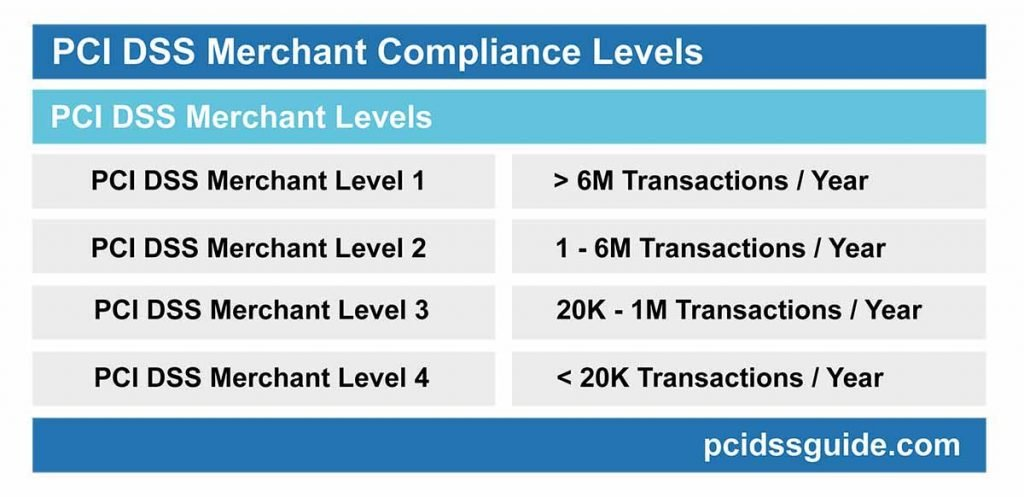

PCI compliance requirements depend on transaction volume. For example, companies are separated into four different levels, with the ones handling less than 20,000 transactions being PCI Level 4 and those that handle more than 6 million being Level 1.

You can start by checking your PCI level with the table above. Violating PCI DSS can lead to legal action and fines against non-compliant businesses.

PSD2

The goal of PSD2 is to protect sensitive customers both directly and by imposing strict rules for payment services. Regarding direct protection, they require customers to authenticate themselves with at least two forms of authentication once they initiate online payments. On the other hand, financial institutions need to provide transparent information on each transaction.

GDPR

The third regulation is GDPR. This is a comprehensive regulation that defines handling and collecting user data. Like the previous two, it’s asking for transparency from businesses.

While it’s targeted toward user data as a whole, credit card transactions and financial details also fall under this category.

4. Prioritize risk management

Let’s talk about keeping your payment processing safe. You need to be smart about how you protect it and who has access.

First things first, regularly check for weak spots. Think of it like a health check-up for your system. You need to know where you’re vulnerable to stop problems before they start.

After successfully integrating a payment gateway into your website, leverage data analytics tools to help you identify transactions that might hint at something fishy.

Now, let’s say something goes wrong. Knock on wood that it doesn’t, but it’s always wise to have a game plan (often known as an incident response plan). Who does what? How do you stop the problem and fix things fast?

Apologizing for any wrongdoing and repaying the damage that a malicious attack or poor business decision caused to your customers and clients help start your journey to rebuilding trust.

And here’s a big one: talk to your team. They’re your front-line defense. Teach them how to spot those sneaky email scams and the tricks hackers use. Remember, a chain is only as strong as its weakest link. And in this case, everyone on your team needs to be in the know. So, think about integrating email security practices into your cybersecurity plan. One of the ways is to implement DMARC policy, which can tell the receiver what to do with unauthenticated emails.

Putting risk management front and center helps you play it safe and build trust. Your customers and stakeholders will see you’re serious about security, and that’s priceless in today’s increasingly digital world.

Protect your bottom line by prioritizing payment processing security

It’s in the best interest of every company to protect your customers.

Unfortunately, some business owners opt to save money at the expense of customer security. A lucky few get away with it for a while until a cyber attack occurs or someone takes a closer look at their protocols.

If you’re a business owner or a decision-maker who already does what they can to protect employees, you should always work on constant improvement. A 100% secure payment processing is impossible, but keeping up with the security trends is the best step towards it.

To do that, the practices found here should help you decide where your security flaws are and your next steps in resolving them. Each new layer of protection improves your payment security, almost always without significant downsides.

About the author:

Outreach Specialist at LeadsBridge, passionate about Marketing and Technology. My goal is to help companies improve their online presence and communication strategy.

Yan Anderson is the Head of Content Marketing at CS-Cart with over 10 years of experience in the eCommerce industry. He's passionate about explaining complicated things in simple terms. Yan has expertise in building, running and growing eCommerce marketplaces. He loves to educate people about best practices, new technologies, and trends in the global eCommerce industry.